Comprehensive Financial Literacy and Credit Repair

“Financial literacy and credit repair are essential skills that everyone should develop.” - ROR Nation

Financial literacy is the foundation of a secure and prosperous future. It encompasses a broad range of skills and knowledge that allows individuals to make informed and effective decisions with their financial resources. One crucial aspect of financial literacy is understanding how to repair and maintain good credit.

What is Financial Literacy?

Financial literacy refers to the ability to understand and apply various financial skills, including personal finance management, budgeting, and investing. It involves:

Budgeting: Creating a plan for how you will spend your money.

Saving: Setting aside money for future needs and emergencies.

Investing: Growing your wealth by putting your money into assets that have the potential to earn returns.

Debt Management: Understanding and managing debt to avoid financial pitfalls.

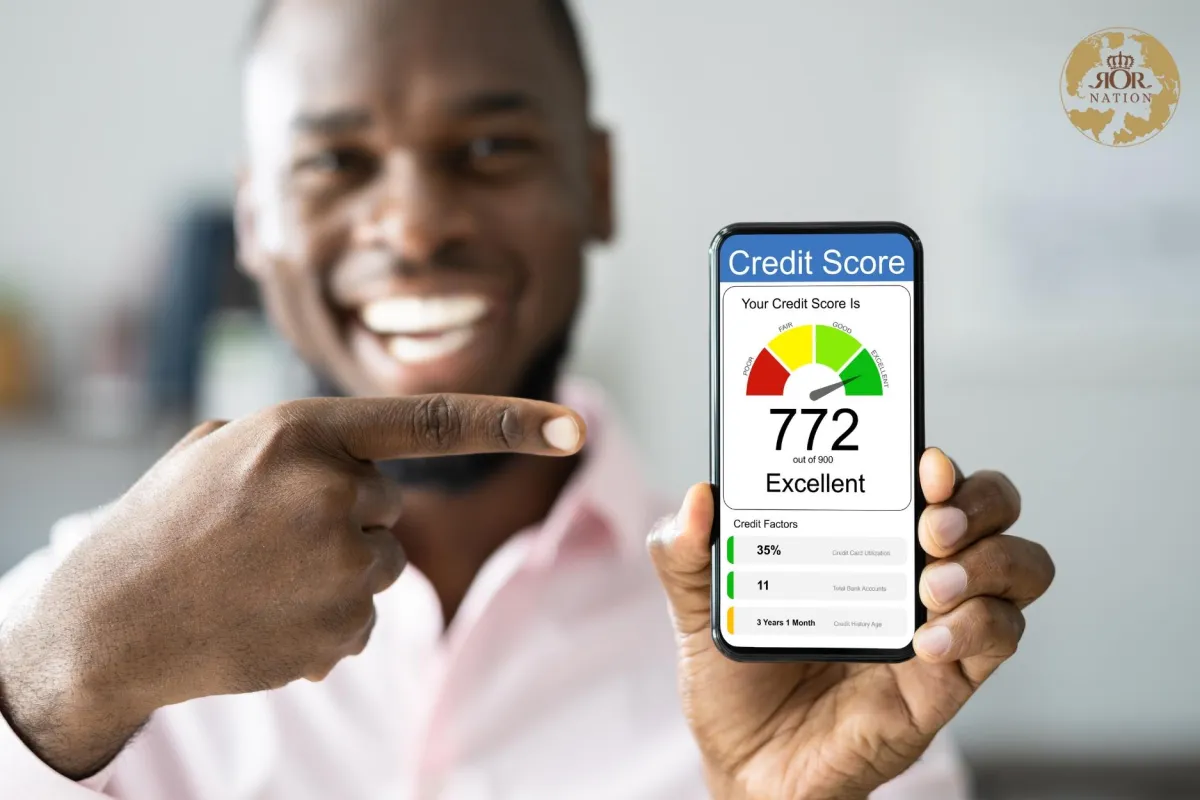

The Importance of Credit Repair

Credit repair is the process of improving your credit score by addressing any negative items on your credit report. A good credit score is vital for:

Loan Approvals: Easier access to loans and credit cards with favorable terms.

Lower Interest Rates: Saving money on interest payments over time.

Housing Opportunities: Increased chances of being approved for rental properties or mortgages.

Employment Opportunities: Some employers check credit scores as part of their hiring process.

Steps to Credit Repair

Get Your Credit Report: Obtain your credit report from the three major credit bureaus (Equifax, Experian, and TransUnion) to review your credit history.

Dispute Errors: Identify and dispute any inaccuracies or errors on your credit report.

Pay Down Debt: Focus on paying down high-interest debt to reduce your credit utilization ratio.

Negotiate with Creditors: Contact creditors to negotiate payment plans or settlements for outstanding debts.

Establish Positive Credit: Build positive credit history by using credit responsibly, such as paying bills on time and keeping balances low.

Educational Resources

Invest in your financial education by taking advantage of resources such as online courses, books, and financial coaching programs. Understanding how to manage your finances and repair your credit will empower you to take control of your financial future.

Financial literacy and credit repair are essential skills that everyone should develop. By taking the time to educate yourself and implement effective financial strategies, you can build a strong financial foundation and achieve long-term success.

FREQUENTLY ASKED QUESTIONS

How long does it take to see results in the Entrepreneurs Coaching Program?

Results vary, but many entrepreneurs report positive changes within the first few months of dedicated coaching.

Are there specific genres catered to in the Music Artist Coaching Program?

No, our program is tailored to accommodate artists from various genres, ensuring a personalized approach to each individual's unique style.

Is the Athletes Coaching Program suitable for amateur athletes?

Absolutely, our program caters to athletes of all levels, providing personalized coaching to enhance their skills and performance.

Can entrepreneurs from any industry benefit from the coaching program?

Yes, our coaching program is designed to be adaptable, catering to entrepreneurs from diverse industries and sectors.

How are coaches selected for the programs?

Coaches undergo a rigorous selection process based on their expertise, experience, and ability to connect with and guide individuals in their respective fields.

Is the coaching program available internationally?

Yes, our coaching programs are accessible globally, offering virtual sessions and resources to accommodate participants worldwide.

Copyright 2024 | ROR Nation | All rights reserved.