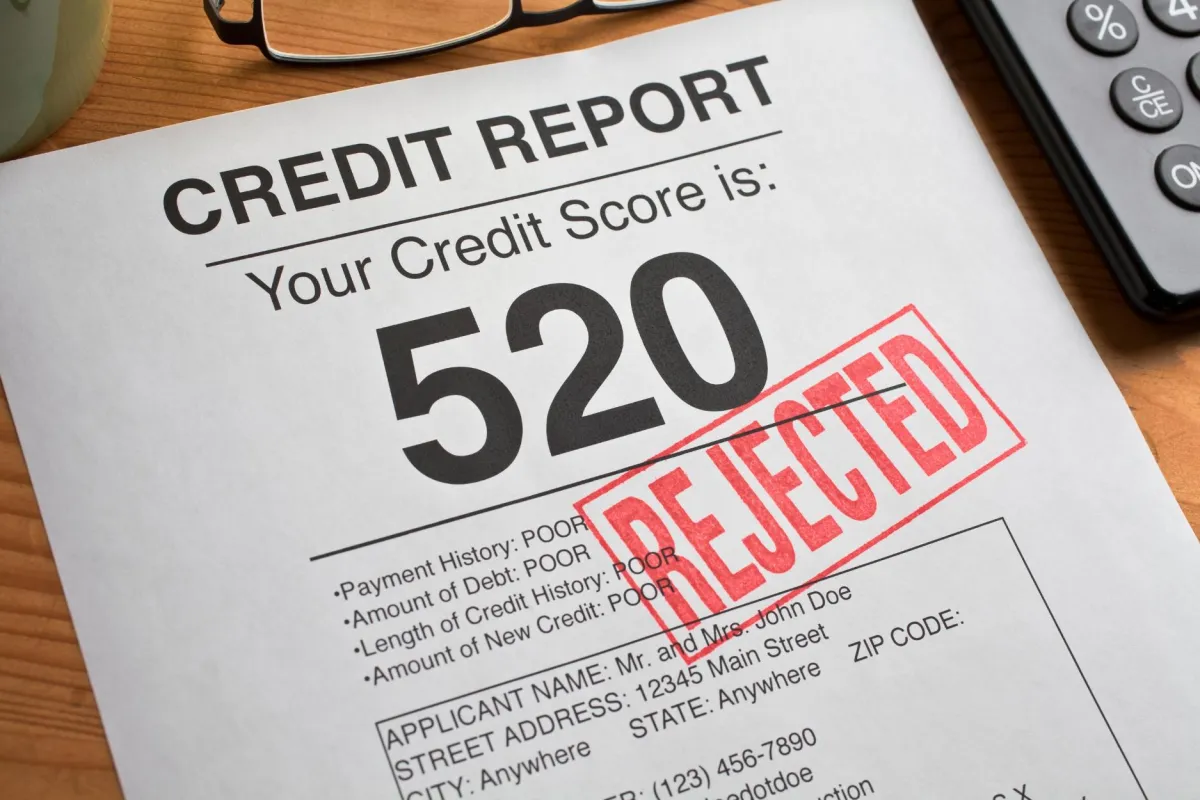

How to Fix Credit DIY: A Guide for Entrepreneurs

As an entrepreneur, maintaining good credit is essential for securing business financing, attracting investors, and managing cash flow. Here's a step-by-step guide to fixing your credit yourself:

Step 1: Review Your Credit Reports

Start by obtaining your credit reports from Equifax, Experian, and TransUnion. Carefully review each report for any errors, inaccuracies, or fraudulent accounts.

Step 2: Dispute Errors

If you find any errors, dispute them with the credit bureaus. Provide documentation to support your claim and follow up to ensure the inaccuracies are corrected.

Step 3: Pay Down High-Interest Debt

Focus on paying down high-interest debts first. This will help lower your credit utilization ratio and improve your credit score. Consider using the debt snowball or debt avalanche method to tackle your debts efficiently.

Step 4: Negotiate with Creditors

Contact your creditors to negotiate payment plans or settlements for outstanding debts. Many creditors are willing to work with you to find a manageable payment solution.

Step 5: Establish Positive Credit

Build positive credit by using credit responsibly. Make all payments on time, keep balances low, and avoid opening too many new accounts at once.

Step 6: Use a Secured Credit Card

If your credit history is limited or damaged, consider getting a secured credit card. Use it for small purchases and pay off the balance in full each month to build positive credit history.

Step 7: Monitor Your Credit Regularly

Regularly monitor your credit reports to track your progress and catch any potential issues early. Use credit monitoring services to stay informed about changes to your credit.

Step 8: Seek Financial Coaching

If you're struggling with the credit repair process, consider seeking help from a financial coach. They can provide personalized advice and strategies to help you improve your credit and manage your finances.

Step 9: Educate Yourself

Invest in your financial education by taking online courses, reading books, and attending workshops on credit management and financial literacy. The more you know, the better equipped you'll be to manage your credit effectively.

Step 10: Stay Committed

Fixing your credit takes time and dedication. Stay committed to your financial goals and remain patient as you work through the credit repair process. With persistence, you can achieve a strong credit profile and secure a brighter financial future for your business.

By following these steps, entrepreneurs can take control of their credit and pave the way for financial success. Good credit is a valuable asset that can open doors to new opportunities and help your business thrive.

FREQUENTLY ASKED QUESTIONS

How long does it take to see results in the Entrepreneurs Coaching Program?

Results vary, but many entrepreneurs report positive changes within the first few months of dedicated coaching.

Are there specific genres catered to in the Music Artist Coaching Program?

No, our program is tailored to accommodate artists from various genres, ensuring a personalized approach to each individual's unique style.

Is the Athletes Coaching Program suitable for amateur athletes?

Absolutely, our program caters to athletes of all levels, providing personalized coaching to enhance their skills and performance.

Can entrepreneurs from any industry benefit from the coaching program?

Yes, our coaching program is designed to be adaptable, catering to entrepreneurs from diverse industries and sectors.

How are coaches selected for the programs?

Coaches undergo a rigorous selection process based on their expertise, experience, and ability to connect with and guide individuals in their respective fields.

Is the coaching program available internationally?

Yes, our coaching programs are accessible globally, offering virtual sessions and resources to accommodate participants worldwide.

Copyright 2024 | ROR Nation | All rights reserved.